Chip Shortage Supercharges Used Data Center Hardware Sales, Says ITRenew

Hyperscalers’ decommissioned gear flies off the shelves as soon as it’s available, according to the vendor.

The global chip shortage is driving more companies to source second-hand hardware for their data centers.

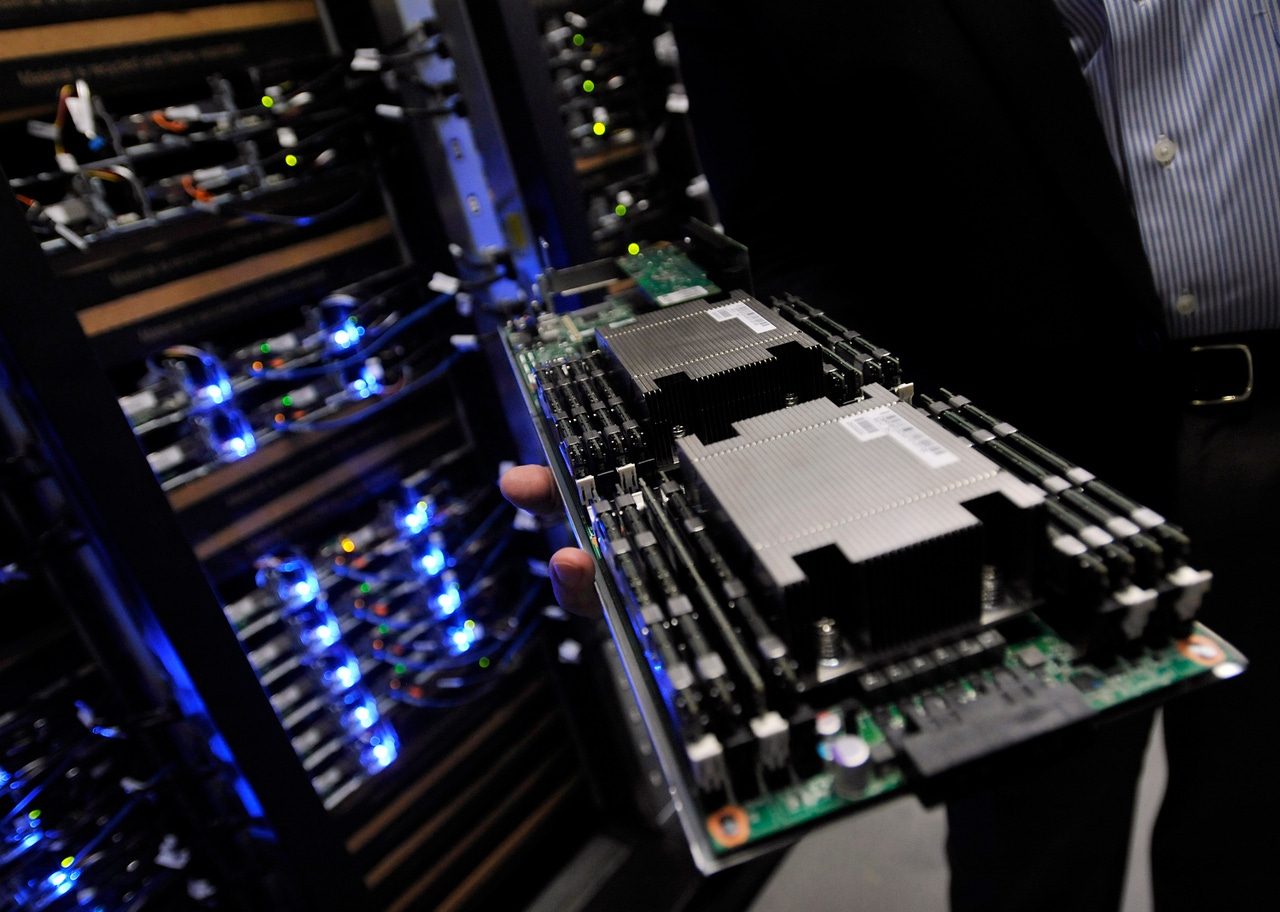

That’s according to Ali Fenn, president at ITRenew, which resells hardware after it’s been removed from hyperscalers’ data centers. These companies, the likes of Facebook or Microsoft, have much shorter hardware refresh cycles than most others, and their gear’s actual useful life can easily be double that of its lifespan inside their massive computing facilities.

“We are moving everything we get as fast as we can get it,” Fenn told DCK, commenting on the chip shortage’s impact on ITRenew’s business. “There’s no shortage of demand.”

Companies that buy individual components and entire systems from ITRenew have all voiced “much longer lead times, orders being canceled.” The customers she hears this from are major enterprises, she said, companies that operate large-scale private cloud environments.

It’s hard to identify many industries that have not been impacted by the chip shortage. The data center industry has been feeling the pain, albeit nowhere near the kind of pain car makers have been experiencing.

That’s mostly because server chips (along with personal-computer chips) are a lot more profitable for chip foundries than other components they produce, so the foundries have prioritized delivering these chips, while extending lead times for other components to, in some cases, unprecedented lengths.

It’s those other components (things like networking-switch silicon, power modules, transistors, resistors, or even PCB circuit boards) that are in short supply, making life complicated for data center-equipment vendors.

ITRenew is seeing these shortages play out on the component side of its business, Fenn said, particularly the shortage of bulk drives and memory.

The company has little visibility into what drives full-solution shortages, since OEMs don’t specify what drives their lead-time expansions. But its customers say, “it’s many months before I can even get a couple of racks [from an OEM] in to try,” Fenn said.

She declined to share any specific numbers about the impact of the crisis on privately held ITRenew’s sales.

Most decommissioned equipment in hyperscalers’ data centers gets sold for parts. Memory and CPUs have the most value on the secondary market.

Fenn said she hasn’t seen any of the hyperscalers extending their hardware refresh cycles to guard against any potential future delays. That’s because these companies are usually first in line for vendors that sell to them, she explained. “They get the inventory that’s available.”

About the Author

You May Also Like