Sweden’s EQT to Purchase Controlling Stake in EdgeConneXSweden’s EQT to Purchase Controlling Stake in EdgeConneX

The move from an international investor known for funding metropolitan car parks and motorways throughout Europe represents a shift in global VC focus, away from physical and towards digital infrastructure.

EQT is investing in the edge. On Wednesday, the Infrastructure division of Sweden-based EQT Partners announced its intention to purchase a controlling stake in EdgeConneX, one of America's pioneer builders of edge data centers, from Rhode Island-based Providence Equity.

Once the deal is completed, sometime in Q4 2020, the holders of the EQT Infrastructure IV fund will control an 85% stake in the data center builder and operator that's presently headquartered in Herndon, Virginia.

"With EQT's backing, I think what we have is a few more arrows in the quiver," EdgeConneX CEO Randy Brouckman told Data Center Knowledge. "And I think you're going to see EdgeConneX in a good position to expand many of our existing edge markets -- and some of our edges have become core markets -- and our new edge markets, absolutely. We wrote the book on that one."

This does not appear to be a strategic shift for EdgeConneX, at least insofar as its CEO was willing to describe it. Rather, it may have been a shift for Providence, the company's existing primary backer, as EdgeConneX builds out more toward what Brouckman describes as the "cloud edge."

EdgeConneX's earliest investors in 2009 and 2010 were mostly the largest cable TV service providers -- Comcast, Charter Communications, and Cox Communications -- along with Akamai. They all wanted to build data center facilities closer to where viewers would put their cloud-based recorded video -- specifically, their cloud DVR recordings -- to use.

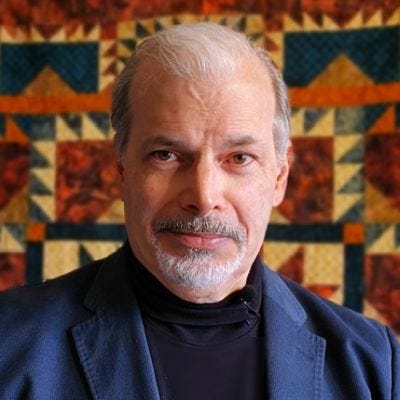

Jim Kerrigan, the legendary real estate consultant, and currently managing principal and founder of North American Data Centers, was involved with the early deals that put EdgeConneX on the map. More accurately, he led rollouts that were all over the map: some 23 markets in a 24-month period, for what Brouckman called "a Herculean task."

In a recent interview, Kerrigan shared with us that these were the first edge data centers, the way we understand that term today.

"As I always explained the edge, the edge could be Chicago," said Kerrigan, "depending on what you're trying to do at the edge." From a broker's point of view, he said, first and foremost, an edge deal is an effort "to get to the eyeballs." Secondly, though still important, would be an effort to move compute capabilities.

"When I started seeing these deals with EdgeConneX on behalf of Charter and Comcast," he said, "it was the first time I really realized how inexpensive the pricing for these transactions were -- so much lower than we've ever seen before."

"We founded the company ... with the big idea being that there's a new edge the network needed and required," EdgeConneX's Brouckman said. "It was necessitated by the fact that we were pulling much more fiber much further and deeper into the network, and we envisioned LTE was going to be a much smoother deployment than 3G was, and was going to facilitate a proper on-ramp and off-ramp to the Internet. Like any highway you build, no matter how many lanes it is, cars fill it. We guessed right on the type of content that would fill it."

In 2013, EdgeConneX constructed its first general-purpose edge data center in Houston. Then two years later, cloud service providers began signaling they needed to take their services and accessibility closer to the enterprise.

"In working with the world's biggest hyperscalers," said Brouckman, "that opened up the opportunity of bringing the data center to where our customers need it — technically, where our customers' customers need it. This concept of location-sensitive data centers is critical, whether you're building out big core nodes near the edge of their clouds, or 'edge-edge' nodes, as we might think about it. And we were able to demonstrate that the core architecture and design of the data centers could scale up from 2 to 20 megawatts, to many tens upon tens of megawatts."

Just a few weeks ago, EdgeConneX's Silicon Valley Holdings II affiliate completed a deal to purchase a 229,000-square foot industrial park in Santa Clara, according to documents first obtained by the San Jose Mercury News. Santa Clara is the part of the world that EdgeConneX had already declared ripe territory for the establishment of edge facilities that could provide AI support for autonomous vehicles.

Brouckman told us that the best geographical locations for such facilities, in his view, would be "where the live and real autonomous vehicle trials are happening." But as EQT expands its investment in EdgeConneX, he warned, such a placement decision should be considered "an instance in time, as opposed to the endgame."

Just last March, EQT Infrastructure and Digital Colony Partners announced the completion of their acquisition of fiber and bandwidth provider Zayo Group Holdings. Clearly, the EdgeConneX move represents one of a chain of bets -- perhaps safe ones -- in the further expansion of cloud service providers into the realm of communications support.

About the Author

You May Also Like