How Utilities, Hyperscalers Are Working to Tackle ‘Extreme’ Data Center Power DemandsHow Utilities, Hyperscalers Are Working to Tackle ‘Extreme’ Data Center Power Demands

Digital infrastructure experts weigh in on the challenges, opportunities, and unanswered questions as the industry confronts a growing power problem.

As AI drives unprecedented growth in data center energy consumption, utilities and hyperscalers are locked in an uneasy, sometimes adversarial partnership to expand capacity.

Data Center Knowledge spoke with technology infrastructure experts about the challenges, opportunities, and unanswered questions facing the industry, as well as the “complex mix” of strategies and technologies required to ensure the grid can meet escalating demand.

Location, Location, Location

As of March this year, half of the 11,000 data centers worldwide were located in the US, according to David Porter, vice president of electrification and sustainable energy strategy at Electric Power Research Institute (EPRI). But Porter, whose research organization advises countries interested in developing new data centers, said the central challenge facing data centers and utilities was the same in the US as in Europe, Asia, or the Middle East: “[That is], whether the location the developer is using has the capacity to serve it in a short time,” he told Data Center Knowledge.

Still, Porter made clear that each jurisdiction has its own regulatory structure and cost frameworks, which can affect the speed and price at which utilities are able to deliver power. Other variables, such as the length of permitting processes in each country, or conflicts like the war in Ukraine, can lead to region-specific constraints and volatility.

Data centers worldwide face similar power challenges, regardless of location (Image: Alamy)

Building a Sustainable Power Grid

In Ireland, where Echelon Data Centres received permits for a new data center just this month for the first time in three years, there has been a “quasi-moratorium” on new construction, Echelon’s head of energy systems Cormac Nevins told Data Center Knowledge.

Calling the growth in power demand “extreme,” Nevins sounded optimistic that policy in Ireland was beginning to move at a speed commensurate with how quickly the industry is changing.

“From 2022 through 2032, we’re looking at doubling data center capacity in Dublin,” he said, describing ambitious government targets. “In the same period, we have to bring in 8 GW of solar, 4.5 GW of onshore wind, and 5 GW of offshore wind. And a bonus of another 2 GW of offshore wind to reach hydrogen targets. These are ambitious targets for renewables.”

Jeffery Shields, senior manager of external communications at PJM, a regional transmission organization (RTO) that serves locations in the US East Coast and Midwest, also forecasts an ambitious use of renewables in the next few years. He said 95% of new projects seeking to interconnect with PJM are renewable energy, and that the company would process 230,000 MW of renewable power by 2026.

“But these projects have to actually get built,” Shields told Data Center Knowledge. “Right now, we are seeing a serious lag in construction. There are about 38,000 MW worth of generation projects that have come through PJM’s study process and should be helping to power the grid but have been held up for numerous reasons, including siting and permitting, supply chain, and financing.”

Who Should Be Responsible for Infrastructure Upgrades?

Discussing a suit filed this month by Google, Amazon, Microsoft, and Meta against an Ohio utility company, AEP Ohio, for its plan to charge hyperscalers increased upfront energy costs for their data centers, Porter said it was not unusual for utilities and large customers to be at odds about who should bear the cost of upgrades.

“The utility regulators for each state have something they think is fair and prudent for all of the customers that utility serves,” he said.

Margarita Patria from Charles River Associates (CRA), a consulting firm that helps utilities such as NIPSCO and FirstEnergy plan for regulation and additional capacity, told Data Center Knowledge: “Whatever entity gets the benefit of the upgrade is the entity that has to pay for it. That’s just and fair to my mind. It becomes a question: who is benefiting?”

Pointing to the September meeting of the Federal Energy Regulatory Committee (FERC), Patria said this was one of the principles advanced by the committee. “If it’s shown multiple entities are benefiting, if there’s a way to quantify benefits, the costs should be shared,” she said.

The suit points to a larger problem, said Satya Thallam, senior vice president of government affairs at Americans for Responsible Innovation, a US non-profit. “We have made it too difficult to build in the US,” Thallam explained. “Energy infrastructure is no exception, and it can take years to simply get the federal permits necessary to break ground, not to mention the years of litigation that often follow.”

Porter disputed that regulation is to blame. “I don’t think we’ve seen anywhere currently where regulatory processes are a hindrance to the construction of data centers,” he said, pointing to what he considered a more fundamental issue facing utilities and developers: access to locations with adequate capacity.

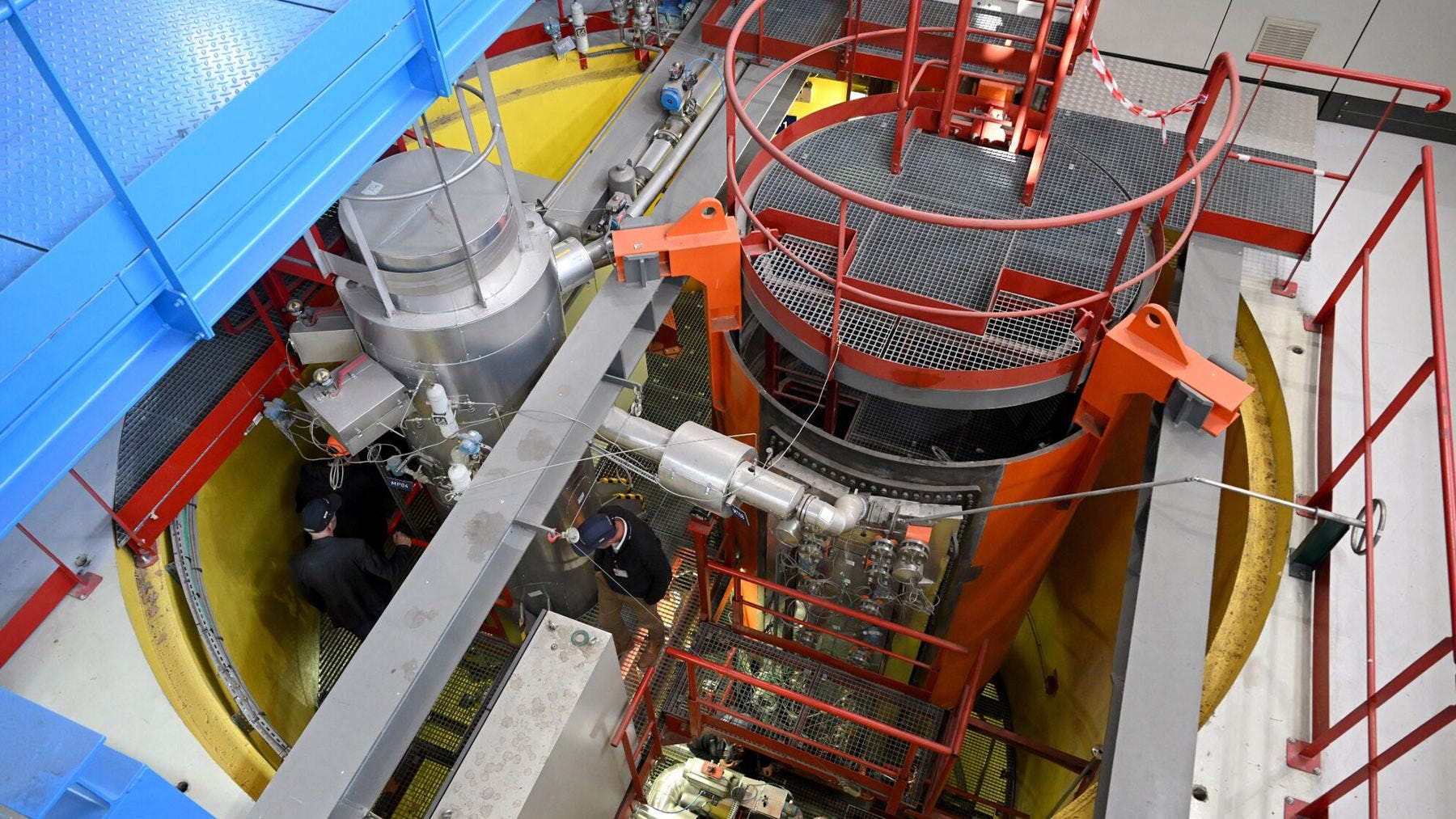

Small Modular Reactors (SMRs) offer a potential solution to meet growing data center power demands, but their widespread adoption could still be years away (Image: Alamy)

SMRs Might Help – Eventually

Asked about Oracle CTO Larry Ellison’s recent announcement that nuclear energy would power some of the company’s new data centers, the experts Data Center Knowledge spoke with described the potential for nuclear power as promising. But, Porter said, “For the current generation of data centers… SMRs [small modular reactors] are not going to have a role there. It won’t be viable in that short of a time. Further down the road, there’s an opportunity.”

Patria referred to the disparity between public perceptions of nuclear energy and how much the technology has advanced in recent years. “The new reactors are a lot more safe and reliable,” she said.

Read more of the latest data center energy news

But there is still resistance, Nevins told Data Center Knowledge, both to SMRs and alternative energy sources more generally. Describing the use of alternative power as “political” in Ireland and the UK, Nevins said that while innovations such as SMRs and carbon capture and storage, as well as the proliferation of wind and solar, will make an impact.

“In the grand scheme of things, not one of them will be a silver bullet,” said Nevins. “It’s a complex mix that will get there in the end.”

No Silver Bullet to the Data Center Power Problem

Porter echoed Nevins’ sentiment that there’s no “silver bullet” to solving the challenges posed by data centers’ soaring power consumption. Instead, he advocated for an ‘all-of-the-above’ approach that includes alternative energy sources, innovations in longer energy duration storage, and projects to enhance existing assets.

“Reconductoring a transmission line to a higher capacity conductor can totally change the amount of energy that can go to a transmission line,” Porter said.

One of the most important initiatives Porter described was an attempt by EPRI to bring together a range of stakeholders – data centers, utilities, and other key players – to better communicate. Then it would be easier to understand how quickly a utility can serve the sector, and if they have time to bring additional assets online.

For her part, Patria highlighted the positive use of AI to speed up interconnection queues. For example, she said, the Midcontinent Independent System Operator (MISO) is using Pearl Street in its software to speed up their interconnection queue.

“We need new generation technology to have AI blossom, and then AI can help the new generation to come online,” Patria said.

Meeting Future Energy Demands

As the data center industry faces unprecedented power demands driven by AI and rapid digital growth, it seems there is no single solution to this growing challenge. Instead, experts agree that a multi-faceted approach, involving alternative energy sources, regulatory improvements, and infrastructure upgrades, will be key to meeting future needs.

While the relationship between stakeholders can sometimes be stretched, close collaboration between utilities, hyperscalers, and regulators will likely be essential in developing sustainable, reliable power solutions that can keep pace with evolving industry demands.

About the Author

You May Also Like