As Data Centers Multiply, Efforts To Control Them Are Growing

Localities are starting to increase taxes and regulations on data centers as the football-field-sized buildings come under greater scrutiny.

May 1, 2024

.jpg?width=1280&auto=webp&quality=95&format=jpg&disable=upscale)

A backlash against internet data centers has triggered a wave of laws around the country to restrain the rapidly growing industry that uses massive amounts of energy to make cloud computing and smart technology possible.

In Northern Virginia, home to the world’s largest concentration of data center buildings, Prince William County last week increased its tax rate on the equipment inside data centers by 72 percent, a response in part to complaints about too many of the football-field-sized facilities being built there.

Neighboring Loudoun County - which is home to most of the data centers in Northern Virginia - is moving to keep the buildings away from homes and some commercial corridors, in part by making all data center projects subject to the county board’s review instead of allowing them as a “by right” development in certain areas.

It’s not just Northern Virginia. In Georgia, the state legislature recently passed legislation that would place a two-year moratorium on tax incentives allotted to the data center industry. And in Arizona, Illinois and Arkansas, officials have passed laws to either suspend data center development or further restrict where they can be built.

“We have to make it worth our while,” Deshundra Jefferson (D), chair of Prince William’s county board, said about her board’s vote to increase the computer and peripherals tax rate to $3.70 per $100 of assessed value, noting that it’s comparable to what neighboring localities charge.

With residents on the county’s western end angry about noise from some data centers and the power lines required to supply them with electricity, Jefferson said, “I don’t feel we’ve been getting our money’s worth.”

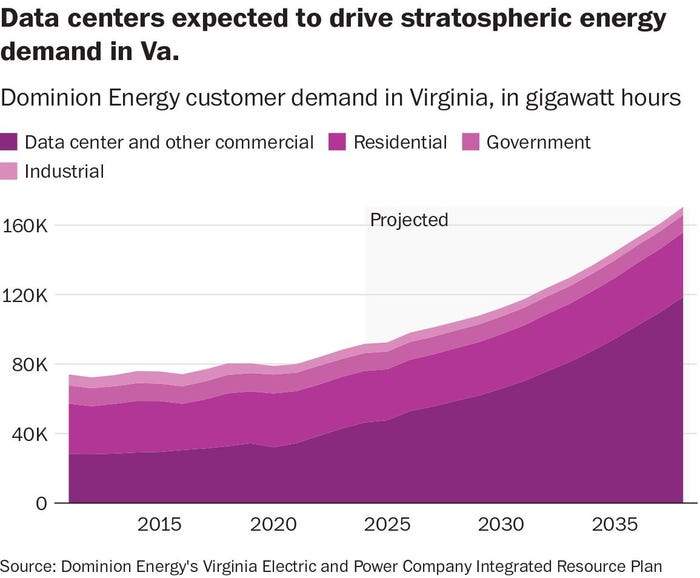

The more stringent approaches to an industry that has been a major source of tax revenue for counties and cities come amid concerns about its impacts on the nation’s electric grid, with individual data centers consuming as much as 50 times more electricity than a typical office building, according to the Department of Energy.

In the portion of the grid that covers the Mid-Atlantic and parts of the Midwest, a projected gap in available energy - driven by the industry’s growth and a wave of anticipated fossil-fuel plant closures - prompted grid operators to ask several coal plants to continue operating as part of a $5.2 billion plan that will leave several hundred miles of new power lines in Virginia and three neighboring states.

Such impacts have placed the data center industry under greater scrutiny, even as many communities continue to woo data center companies as a source of economic development.

Virginia’s General Assembly recently launched a study of the industry’s impacts - both positive and negative - after a host of bills seeking to further regulate data centers were introduced during the past two years.

<="" p="" height="80">

<="" p="" height="80">

In Georgia, the legislation to place a moratorium on tax incentives - which Gov. Brian Kemp (R) has yet to sign amid pleas for a veto from the industry - would launch a similar study after the state’s largest utility said it would need a significant boost in energy capacity to keep up with the demand for power.

“These data centers continue to use a disproportionate amount of our state’s energy,” Georgia’s House Speaker Jon Burns (R) said when the bill was introduced in February. “We have to make sure we balance that and we have resources available.”

Kemp’s office said Friday it is still reviewing the bill.

Josh Levi, president of the Data Center Coalition industry group, said the facilities have more positive benefits than a negative impacts.

“Data is clearly the lifeblood of our economy,” Levi said. “Everything that we’re doing in our personal and professional lives really depends on the digital infrastructure that our facilities deploy.”

Levi, who called the moratorium in Georgia “a disturbing and concerning signal” to an industry that has created thousands of jobs in that state, said data center companies have worked to minimize their impact on the electric grid and reduce greenhouse emissions.

Companies are investing heavily in carbon-free energy projects, such as solar and wind farms, that would directly supply their facilities, he said.

But many of those projects are not yet operating due to problems with permitting or financing, part of a larger lag in connecting enough green energy to the grid to address the projected power gap.

“There are some real systemic challenges people are facing as we look at the grid,” Levi said. “From an industry perspective, we are having a lot of discussions now with utilities and grid operators and regulators and policymakers across the country to talk about these challenges.”

Meanwhile, frustrations with the industry continue.

In Arizona, residents in the city of Chandler complained for years about the extra power lines needed to service the city’s five data center complexes and the noise from the cooling equipment, said Kevin Mayo, the city’s planning administrator. The city recently tightened its requirements for data centers, including by restricting future development to designated planned area development districts that are away from residential areas.

Data center companies that want to build in Chandler also must explain how their presence will benefit the community.

That’s a hard sell in a drought-prone city that has also been wary of the industry’s water consumption for cooling computer servers and other equipment. Mayo said Chandler receives very little in tax revenue from data center companies due to recent tax cuts by the state.

“They don’t really bring any jobs, the taxation levels were lowered to the point where they don’t really bring a fiscal benefit to the city, and they require an enormous amount of power,” Mayo said. “We struggle with being able to tell the story that this is a communal benefit.”

But with the industry now spreading to other areas of the country, some officials say the tougher laws may simply lure data center companies away, depriving their communities of economic benefits.

In Prince William County, Supervisor Victor S. Angry (D-Neabsco), the sole board member to vote against the tax rate hike on data centers, warned that it sends a signal of unpredictability to an industry that contributes $100 million to county coffers, with about 31 data centers there.

Prince William already raised the tax rate last year by about 20 percent and indicated that any future increases would happen gradually, Angry said.

“What we’re dealing with is our word; that you can trust us when we say we’re going to do something and hold to it,” he said.

Robert Sweeney, president of the Prince William Chamber of Commerce, said the higher tax rate also applies to about 5,000 smaller businesses in Prince William that also use computer equipment in their operations.

“They could have waited to do this tax increase next year; instead, they just rapid-fired it,” Sweeney said, about the county board, calling the hike a political move by Jefferson to appease data center opponents in the county who helped her get elected in November.

Jefferson, who as a candidate tapped into anger over recently approved plans for a “Digital Gateway” complex in the county that will include as many as 34 data centers, said she had signaled her intention to raise the tax rate while campaigning.

The nearly $60 million in extra tax revenue generated by the increase will allow the county to boost funding for schools and parks and, in the next budget, slightly lower the tax rate for homeowners to $0.92 per $100 of assessed value, she said.

So far, the move has not deterred future investment. On Friday, Google announced it plans to spend $1 billion to expand its data centers in Prince William and Loudoun counties. Compass Datacenters, one of the two technology companies that will build the Digital Gateway, said earlier last week that the tax hike has not affected that plan.

“I don’t see this slowing the industry down,” Jefferson said. “Data centers want to be in Prince William County. But we have to make it worth our while.”

In Loudoun County, a data center has been in some stage of construction every day during the past 14 years, said Supervisor Michael R. Turner (D-Sterling), who has led efforts to curtail the industry’s growth.

Loudoun is now home to about 180 data centers, consuming 3,200 megawatts of power, enough to power 2.5 million homes, or triple the amount in 2019, Turner said. By 2032, that demand is expected to climb to 7,000 megawatts.

With its new policies, the county said it is seeking to strike a balance between frustrations over the industry’s presence - particularly near homes and schools - with the fact that the $600 million in annual tax revenue it generates has helped insulate Loudoun against a pandemic-caused downturn in the commercial real estate market affecting other localities in the D.C. region.

“It’s a fast-moving train and a rapidly shifting environment,” Turner said about the industry’s growth as digital technology continues to develop, requiring more data centers and, in turn, more electricity and power lines to keep those facilities operating. “I just know those trends are not going to change anytime soon.”

About the Author

You May Also Like