GE Bets on LinkedIn’s Data Center Standard for Predix at the EdgeGE Bets on LinkedIn’s Data Center Standard for Predix at the Edge

Why the giant wants to standardize edge compute for industrial IoT on Open19

LinkedIn is spearheading a new open source standard for the way servers are designed and deployed in data centers, and it has a big partner to help grow an ecosystem around the standard. GE Digital, General Electric’s software unit, is planning to adopt it for deploying edge data center solutions for users of Predix, its industrial Internet of Things platform.

Whether it’s collecting and analyzing sensor data from a chemical manufacturing plant, from an off-shore oil rig, or from a jet engine, near-real time feedback based on the analysis means there has to be some computing muscle close to where the data is generated. Even with the fastest networks, the amount of time it would take for data to travel from a factory or an aircraft to a central data center hundreds or thousands of miles away and back would be simply too big.

“We have 1 to 2 millisecond latency [limit] to figure out if a turbine’s going to start malfunctioning,” Darren Haas, GE Digital’s senior VP for cloud and data, said in an interview with Data Center Knowledge. Haas joined GE last year after six years as head of cloud engineering at Apple, where he ended up after Apple acquired Siri, Inc. He was part of the original team of engineers that built the technology that powers the world’s most famous virtual assistant.

GE’s solution to the latency problem is to ship a “Predix box,” which will combine all the hardware and software needed for processing the data on-site, to whatever location a client needs that computing muscle in, Haas said. “We’re going to get Predix completely loaded on it and just drop-ship them everywhere. The locations we’re looking at are all across the world.”

GE has a lot riding on Predix, the crown jewel of a software unit it expects to grow from $6 billion last year to $15 billion in 2020. Industrial IoT is viewed as core to the next chapter in the American titan’s history. Predix is a global cloud platform designed for developers to build and deploy industrial IoT applications. GE uses Amazon Web Services and may use Microsoft Azure in the future to host the core Predix platform, which will communicate with edge nodes at customer sites, Haas said.

He expects LinkedIn’s hardware standard, called Open19, to make the process of deploying those edge nodes easier, because the hardware will be the same, regardless of where it’s being installed. Predix is designed to enable developers to build software that can move between different “form factors, environments, and regions, but we still wrestle with different standards and systems by node, region, and vendor,” Haas said in a statement. The standard will “allow us to deliver racks quickly, reduce deployment costs, and have a wider inventory, making sourcing easier than custom solutions, regardless of environment.”

In other words, if numerous hardware makers around the world adopt the standard – and several of them have already put that process in motion – GE will not be limited to the sales and manufacturing cycles of one or two suppliers and their ability to deliver globally.

The Ecosystem is Everything

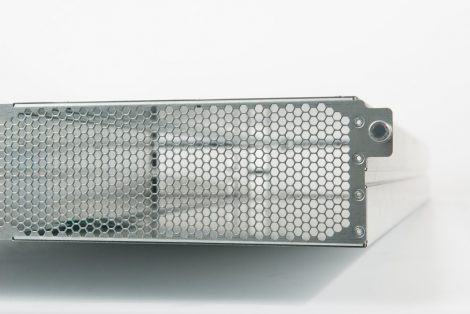

Open19 describes a cage that can be installed in a standard 19-inches-wide data center rack and filled with standard “brick” servers of various default widths and heights (half-width, full-width, single-rack unit height, double height). It also includes two power-shelf options, a single network switch for every two cages, and cable-less power and network connectors on the servers that plug into a shared backplane. A data center technician can quickly screw the cage into a rack and slide the bricks in, without the need to connect cables for every box.

Hardware based on the standard isn’t yet production-ready, Yuval Bachar, LinkedIn’s principal engineer for global infrastructure architecture and strategy and Open19’s key advocate, said. Earlier this month, LinkedIn, together with GE, Hewlett Packard Enterprise, and a number of other hardware and software makers, launched a non-profit foundation to oversee further development of the standard and, importantly, build an ecosystem of vendors and end users around it. If that ecosystem doesn’t gain a certain critical mass, Open19 will remain little more than LinkedIn’s custom hardware spec. In other words, not a standard.

But there’s a lot of excitement about the effort among vendors, with Flex, the electronics manufacturing giant formerly known as Flextronics, using it as a platform to enter the data center market as a vendor that sells hardware directly to end users rather than simply manufacturing it on behalf of other sellers. HPE is planning to make its line of hardware products for hyper-scale data centers called Cloudline compliant with Open19, Kara Long, an HPE senior director who oversees hyper-scale product management, said.

HPE, Flex, and the Chinese hardware maker Inspur had prototype Open19 gear on display at the foundation’s launch event held at Flex offices in Santa Clara, California. Vendors involved in the launch also included Supermicro, Wiwynn, hyve, QCT, Broadcom, Marvell, Cavium, Schneider Electric, and Vapor IO, among others.

OCP-Like Prices at Lower Purchase Volumes

After conversations with vendors about Open19 hardware for Predix, Haas expects to buy it at a price that’s competitive with hardware designed to specifications of the Open Compute Project, an established open source hardware design community spearheaded by Facebook. But vendors selling OCP gear (many of them are now also involved in Open19) are mainly interested in selling large volumes to hyper-scale buyers, such as Facebook and Microsoft, at steep discounts that come with large-volume orders.

Unlike most OCP-compliant products, designed for custom OCP racks and electrical distribution, LinkedIn developed Open19 so that it can be deployed in any standard data center, making it more feasible for vendors to manufacture and sell the gear in smaller volumes. And Haas expects to get OCP-like prices with “very minimal purchase size.” GE needs to start rolling out the edge infrastructure for Predix fairly quickly, he said.

Read more: LinkedIn's Data Center Standard Aims to Do What OCP Hasn't

Zero-Touch Edge Nodes with AI Capabilities

The plan is to make Predix boxes as hands-off for customers as possible. “We don’t want any of the people that we drop these boxes on to have to do anything, so it has to be zero-touch, full automation,” Haas said.

Many of the edge nodes will have to provide high enough performance to handle Machine Learning workloads, he said. Several people involved in Open19 have indicated that high-density GPU servers for Machine Learning that are compliant with the standard are being considered.

Late last year, GE Digital acquired a startup called Wise.io to accelerate development of Predix Machine Learning capabilities. While a lot of the development and training of Machine Learning models for Predix will be done in the cloud, with the final models shipped out to the edge, Haas expects some of those edge workloads to require lots of compute muscle per square foot, with power densities going north of 20kW per rack in some cases. “We’re working on some pretty crazy modeling at the edge,” he said.

See also: Micro-Data Centers Out in the Wild: How Dense is the Edge?

The Flexibility Trade-off

While GE’s strategy for Predix computing at the edge makes sense, committing to a single hardware standard has its pros and cons, Ashish Nadkarni, computing platforms program director at the market research firm IDC, said. On the one hand, by participating in the standard’s development you can push it in a direction that’s suitable for your needs, or design custom hardware that’s compliant and can be delivered by multiple vendors; on the other hand, a standard is only as good as the ecosystem around it.

LinkedIn and GE are for now the only hardware customers who officially support Open19. Yes, there is a number of vendors who are involved, but more buyers will have to join for those vendors to stay committed and for new ones to sign on.

The fact that LinkedIn is now owned by Microsoft, one of the two biggest users of OCP gear that’s standardized on OCP across its entire global cloud infrastructure, adds another element of uncertainty. Will its new parent company eventually decide to consolidate LinkedIn’s infrastructure into its own facilities, depriving Open19 of its core founding user? Microsoft hasn’t yet made a decision either way, but that kind of consolidation is a common step for companies.

For the strategy to work, GE will also have to sell its Predix customers on Open19, Nadkarni said. “That’s going to ultimately decide how Predix pans out.” A better strategy, in his opinion, would be to make edge software for the IoT platform independent of the type of hardware it runs on, he said. Whether that’s possible technically, given GE’s plans for a zero-touch, fully automated solution and sophisticated Machine Learning workloads at the edge, is unclear. (Haas mentioned plans to work with hardware vendors on a software layer underneath Predix that would ensure the compute and memory resources deliver the kind of performance necessary for those workloads.)

“The GE Predix strategy [for edge computing] has to be more flexible,” Nadkarni said. “It has to be independent of a data center rack standard.”

Correction: The previous version of this article incorrectly stated that GE uses Microsoft Azure to host core infrastructure for Predix. That core infrastructure is actually hosted on Amazon Web Services, but GE may also use Azure in the future, according to a company spokesperson.

About the Author

You May Also Like