HPE to Stop Selling Commodity Servers to Hyper-Scale Cloud CompaniesHPE to Stop Selling Commodity Servers to Hyper-Scale Cloud Companies

Says will focus on higher-end hardware sales to enterprises and hyper-scalers

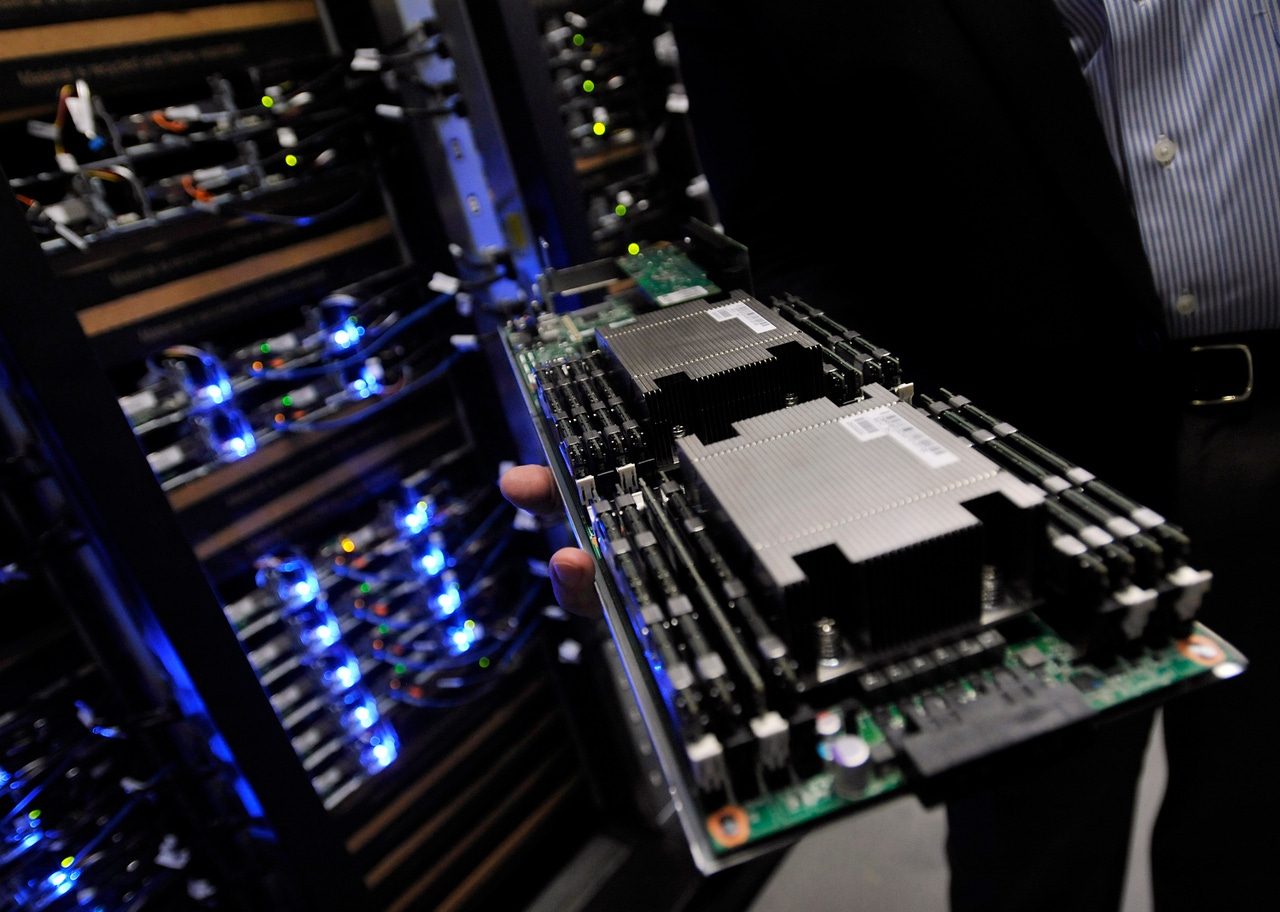

Hewlett Packard Enterprise is getting out of the business of supplying bulk orders of stripped-down commodity servers to cloud giants like Amazon, Microsoft, and Alibaba.

After seeing their server sales drop when cloud companies started ordering their custom computers directly from manufacturers in Asia, HPE (then HP) and Dell both introduced product lines for commodity gear to better compete in that space.

But competition has been tough. In March, HPE chief executive Meg Whitman said publicly that the company was feeling pain from “significantly lower demand” for servers just from one tier-1 service provider. Anonymous sources told Bloomberg that provider was Microsoft.

Speaking at an analyst event last week in San Francisco, Whitman said the company would no longer compete in the low-cost hardware business, focusing instead on higher-margin gear, such as high-end servers, hyper-converged infrastructure, storage, and networking equipment, some of which it would continue selling to tier-1 cloud players, Fortune reported.

But all hyper-scale cloud operators have substantial hardware design operations of their own, and there’s no guarantee they won’t turn to the same Asian design manufacturers for the higher-end gear too. Facebook, Microsoft, Amazon, and Google have been designing their own network switches, for example, and at least Facebook and Microsoft also use custom storage gear.

Many of those cloud hardware specifications are open source, making it even harder for the likes of HPE and Dell to differentiate from the design manufacturers. Both US vendors and Asian makers -- such as Quanta and Wiwynn -- are members of the Open Compute Project, the vehicle through which Facebook, Microsoft, and others open source their custom specs and have suppliers compete among each other for large orders of data center hardware built to those specs. Because the designs are open, the only levers suppliers can pull in the competition are price and delivery times.

Now that cloud giants, who are the world’s largest hardware buyers, now dictate market rules, choosing how the hardware is built and what it costs, HPE has a much bigger chance at succeeding in selling hardware to traditional enterprises – the banks, the insurance companies, the manufacturers, the retailers – who haven’t invested in their own hardware design capabilities.

At least for now, Asian manufacturers haven’t shown a lot of interest in delivering lower-volume orders of open source hardware to those kinds of customers. Commodity hardware is a low-margin business, which only makes sense with large orders.

Unless enterprises start banding together to make large-enough orders of OCP hardware from the likes of Quanta, HPE can still get some runway out of the enterprise market. But there’s another problem: the accelerating migration of enterprise workloads to cloud services, hosted in the hyper-scale data centers filled with commodity hardware.

About the Author

You May Also Like