Done: DigitalBridge and IFM Take Switch Private for $11BDone: DigitalBridge and IFM Take Switch Private for $11B

DigitalBridge and IFM complete the conversion of data center company Switch from publicly traded to privately held. We take a look at the conversion and how it fits into a recent trend.

December 7, 2022

Today DigitalBridge and IFM announced the completion of a transaction to convert data center company Switch from a publicly traded company to private equity ownership. The transaction costs the private equity groups $11 billion to buy out shares of Switch and to pay off residual debt.

This acquisition news was much anticipated and was the subject of speculation in 2022. There were rumblings about a possible merger or acquisition of Switch as far back as May 10 of this year. The following day, the news broke that indeed DigitalBridge and IFM’s conversion of Switch from public to private was in the works.

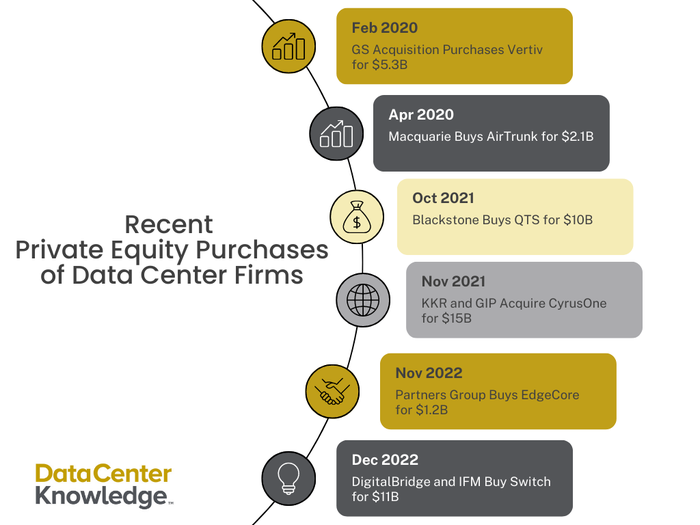

In the last two years, data center acquisition activity has increased dramatically. Here’s a timeline of the largest transactions from 2020 to 2022:

Timeline of PE Purchases of Data Centers

Some analysts speculate colos must seek private equity funds to make good on commitments to customers for space in their facilities.

For instance, Vlad Galabov, director of research at Omdia, told Data Center Knowledge that the opportunity for colos to go private is the funding for new waves of expansion.

Profile of a private equity colo

DigitalBridge and KKR appear to be the most active private equity investor groups in this space. Acquisitions by this firms follow a specific structure of:

Partnership with another private equity group. In the case of the Switch transaction DigitalBridge partnered with IFM, an infrastructure management company based in Australia.

Targeting of mid-sized colos with strong market caps.

For instance, DataBank was purchased by DigitalBridge in July 2016 for $4 billion in one of the earlier transactions of this kind in the data center space. The firm’s current CEO, Raul Martynek, shared the profile of a data center company that provides value to private equity firms.

“Companies that look like DataBank (mid-sized colocation companies) are usually funded with various bank debt instruments, which typically come with a blended interest rate of 6% to 7%,” Martynek shared with Data Center Knowledge.

Galabov believes larger firms in the colocation space may be immune to the current wave of private equity acquisitions.

“It [Switch] is the last of the big 6 colocation companies (Equinix, Digital Realty, CyrusOne, CoreSite, QTS, Switch) to be acquired by a PE firm,” Galabov said. “Equinix and Digital Realty are too big and likely too costly for such a transaction.”

This isn’t to say there aren’t risks in connecting a firm’s future with a private equity firm.

“The acquisition holds some risks for Switch and some opportunities but knowing the character of Switch’s founder and designer, Rob Roy, I expect that the risks have been discussed at length with DigitalBridge,” Galabov shared. “Generally speaking, the risks are a PE firm mismanaging an acquisition by tightening R&D spend and generally taking too few risks.”

Some believe firms have a right to be concerned. In a recent article on Data Center Knowledge, Omdia principal analyst Alan Howard shared his initial misgivings about private equity’s involvement in the data center industry.

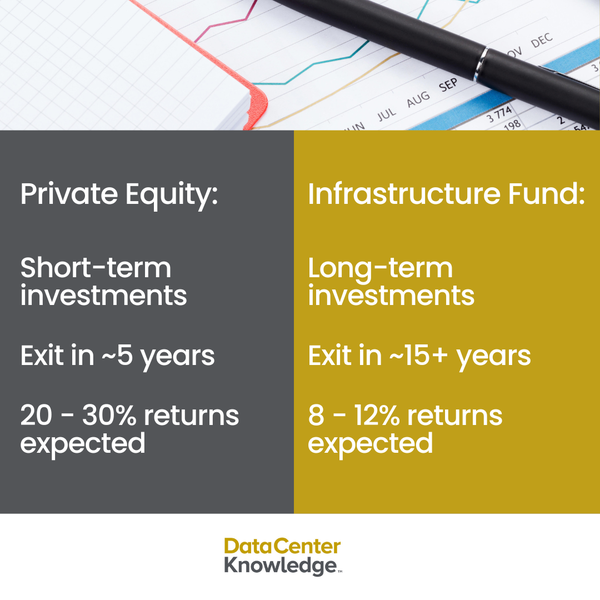

Private Equity comparison

“It’s key to understand private equity investor types: The words “private equity investor” can mean a great many things but being an infrastructure fund investor is a very specific type of private equity investing,” Howard wrote.

Howard’s final take on private equity: “Infrastructure funds have become some of the most sophisticated investors in the data center space and have proven to be good stewards of their portfolio assets”

Who’s Next?

The next firm in the sights of major infrastructure funds is Global Switch Holdings Ltd., according to a Nov. 22 report by Bloomberg News.

The transaction is shaping up to be a tricky one since current bidders, among them KKR, PAG, and EQT, aren’t matching Global Switch’s valuation aspirations.

Updated on Dec. 8, 2022 at 5:37 p.m. EST - DataBank CEO Raul Martynek was listed as Paul Martynek, in error, in a previous version of this article.

About the Author

You May Also Like